UNELCO is well aware that electricity is quite costly in Vanuatu and understands why customers often ask why it is so.

This page aims to explain some of the elements that contribute to this cost.

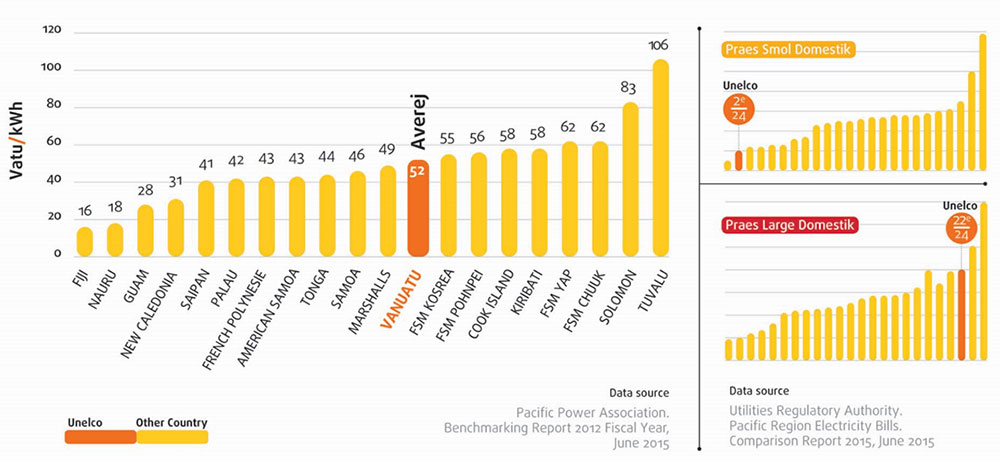

As a prelude, it must be noted that the cost of electricity in Vanuatu is within the average of other small Pacific islands but that it is undeniable that the structural costs of producing, distributing and commercializing electricity in Efaté are objectively high compared to the rest of the continental utilities.

Factor

Pacifique

Electricity tariffs are determined on the basis of the conditions stipulated in the Concession Agreement between the Government of Vanuatu and UNELCO

Breakdown of Electricity

ELECTRICITY RATES applicable from the 1st to the 31st of each month in accordance with the terms and condition relating to the Concessions for the production and supply of electricity in Port-Vila.

Electricity tariffAverage electricity cost in the Pacific Island countries

INTER ISLAND SOLIDARITY AND BETWEEN CUSTOMERS

The tariff policy assures a solidarity mechanism between different customers of UNELCO concessions : EFATE, TANNA and MALEKULA

Did you know that 10 Vatu/kWh paid by Large Domestic Customers allows 7000 small domestic customers and streed lighting to benefit from rates that are subsidized by 46-66% ?

Who fix the electricity rates?

Electricity tariffs are determined on the basis of the conditions stipulated in the Concession Agreement between the Government of Vanuatu and UNELCO, international best practice in tariff determination, the investment plan and the socio-economic priorities of the Government.

The Government and UNELCO undertake a review of electricity tariffs at regular intervals, usually every 5 years. The Public Utility Regulatory Authority (URA) generally acts on behalf of the Government in the tariff review process.

In case of disagreement between the Government and UNELCO on the scope of the tariff revision, the disagreement is referred to a specialized and neutral entity. The last tariff revision took place in May 2011 pursuant to the decisions of the Arbitral Tribunal in Australia.

How is the tariff determined?

Once the basic tariff has been established, in accordance with the abovementioned rules, this tariff is adjusted every month in order to take account of the evolution of the economic parameters affecting the costs of the water system, in particular the price of the electricity needed for pumping and the inflation suffered by the different types of costs.

The discount formula was also determined in May 2011 as part of the latest tariff revision and UNELCO provided monthly to the Public Utility Regulatory Office (URA) the supporting documents associated with the evolution of the discounting parameters

How are the electricity bills established?

Monthly electricity bills are established in accordance with the provisions of the subscription policy and the concession contract.

Except in the rare cases of temporary non-accessibility of a meter, the invoice is based on meter consumption index readings, the number of days between each relay, the applicable rate and the current VAT level.

When is the electricity invoice due?

Electricity bills are due on or before the 15th of the month following the month of issue of the invoice.

Why is electricity costly in Vanuatu and other small Pacific islands

UNELCO is well aware that electricity is quite costly in Vanuatu and understands why customers often ask why it is so. This page aims to explain some of the elements that contribute to this cost.

As a prelude, it must be noted that the cost of electricity in Vanuatu is within the average of other small Pacific islands but that it is undeniable that the structural costs of producing, distributing and commercializing electricity in Efaté, Tanna and Malekula are objectively high compared to the rest of the continental utilities.

The core factors that contribute to additional expenses in each aspect of the electricity value chain can be summarized as follows:

- Generation: Reliance on oil and the absence of alternative « cheap » fossil fuels or local sources of renewable energy. Unfortunately UNELCO concession areas neither have any cheap renewable energy technologies - such as large scale hydro (such as available in Fiji or Tahiti for example), large scale geothermal (such as available in NZ for example), large wind (such as available in Germany for example) or PV solar with desert type irradiance (such as the Southern United States or Australia for example) - nor even “cheap” fossil fuels - such as coal, locally produced and sub-market price petrol / natural gas – that could be used for generation until 100% renewables can be reached in 2030. In addition, certain technologies are not available at our island’s scale, such as nuclear or coal, or have somewhat lower efficiencies because of the small size of the units (ex. oil generators).

The generation expense represents roughly 38% of the current electricity costs. - Transmission and distribution: Small non-interconnected distribution networks. In small distribution networks, the economies of scale are limited, the meshing of that network is limited and hence the use of each line and transformer is limited; thereby significantly increasing the cost per kWh delivered.

Transmission and distribution represents roughly 22% of the current electricity costs - Commercial/Retail: Many of the custom utility information technology solutions (whether IT backbone, field force enablement, payment solutions etc.) which aim to increase retail efficiency are not deployable at small scale (high development cost for too few users). As a result, many of the operations must remain manual and incur higher cost.

Commercial expenses represent roughly 4% of the current electricity costs. - Shipping, procurement and inventories. Distance and scale increase the unit procurement and shipping costs significantly; in additional, the distance, time and the absence of any other interconnected networks forces the utility to be “self sufficient” and have significantly more inventory than a continental utility would have

- Support functions: All the support functions - Finance, Human Resources, Information Technology, Marketing and Communication, Legal – are required, specific to the Vanuatu context (local laws, local staff etc.) but the utility has limited economies of scale because of the size of the utility.

Support function expenses represent roughly 8% of current electricity costs - Taxes and contributions. Customers invoices include 15% VAT (a relatively high amount by regional standards), plus a Generation Fuel Excise Tax which represents roughly 10% of the invoice, plus an approximately 2% regulatory surcharge, plus development fund contributions, duties and other indirect taxes.

Overall, approximately 28% of collected amounts are not associated to UNELCO electricity service expenses but are mandatory and simply remitted to third parties.

Beyond the value chain breakdown above, there are specific attributes, otherwise called “degree of adversity”, of each insular territory with which the electric operator must contend predict quite well the level of the electricity cost to the final customer.

The degree of adversity can be characterized by the following geographic, economic and social factors:

- The availability of affordable local energy sources: Is there a cheap source of energy in the country?

Whether it be coal, sub-market price fossil fuels, large hydroelectric dams, large geothermal resources etc. This is the key driver for the overall cost of electricity and the one of the main elements that explains inter-island differences. - The distance from a continent. How far are the utility territories from a substantial market / continent? This will affect the amount of redundancy required by the utility, the amount of buffer inventory to carry, the additional costs associated to shipping etc.

- The degree of fragmentation of the territory. How many electrically separate territories must the utility serve? When a utility must operate several non-interconnected networks, it multiplies the investments and costs, as each must be capable or running autonomously.

- The distance of dispersion of the territories. How far apart are the electrically separate territories that the utility must serve? The further apart the different utility territories are, the higher the logistics costs involved. If the territories are separated by sea, the logistics issues and therefore costs increase.

- The size of each territory. How large is each of the electric territories (either measured in terms of customers or kWhs delivered per year)?

The smaller the generation units, the distribution organs, the higher the unit cost per kWh delivered. - The density and economic makeup of the territory. How many electric customers are there per square kilometer of territory and what is the balance of customers between domestic/professional/administration/large industrial?

The less dense and the more “rural” the electric network, the more it costs per kWh delivered (additional Km of line for sometimes only a handful of customers).

The more reliant the network is on small domestic customers, the more expensive it is to operate, per kWh delivered. In many large countries, with a large industrial base, their large demand pays for most of the electric infrastructure and creates economies of scale. - The relative wealth of territory and the country risk. How wealthy is the country or territory and what is the country risk premium?

The capacity to pay of customers and Government is linked to the wealth of the territory. In countries were wealth is limited, utility invoice payment times usually increase, rates of disconnection for unpaid bills increase, and as a result, the cost of the working capital required increases for the utility.

Also, when a country’s risk – either economical, political or other – is higher, or when it is grey or blacklisted, the cost of capital increases all along the electric chain; international suppliers request higher upfront payments (some refuse to do business), operators need a higher rate of return to compensate the risk, sources of debt and capital are more limited, etc.

Finally, when the wealth of the country is limited, the utility must take on all investments itself (rather than having Government finance certain core projects). Making these investments for access requires significant capital and these costs are borne by electricity customers (while in other countries these costs could partially borne by taxpayers). - The exposure to geo-climactic hazards. How many natural disasters is the country/territory exposed to, at what frequency, and with which degree of gravity?

The exposure to natural disasters is particularly sensitive for electric operators as their assets are spread out all over the public domain (vs. other businesses where assets are within an office, a warehouse or factory). Exposure to natural hazards increases costs all along the value chain as: there is a cost to purchasing “cyclone-resistant” materials, emergency inventories are higher, demand and hence revenue volatility is higher, resilience equipment must be in place, insurance costs are higher and coverage is partial, repair and cleanup costs are substantial etc.

Obviously, the more natural disasters the territory is exposed to, in terms of type (cyclones, tsunamis, earthquakes, volcanic eruptions, bush fires etc.), frequency and gravity, the higher the preventive and curative expenses for the utility. - The expectation in terms of quality, continuity of service, safety and security. What are the contractual, regulatory and/or customary expectations from the utility in terms of service and safety?

There is always an implied service expectation from the Grantor of the concession and customers, whether it is providing 24/7 power (or as many insular utilities, only power a few hours a day), the number of hours of discontinuity of service per year (costs increase substantially as the utility drives towards less and less hours, in particular in an insular context, because of the required redundancies), the speed of intervention for new connections/outages/services calls (all staff and resource intensive activities), the consistency of the voltage output etc. In addition, there is a sometimes hidden parameter, which is safety (of persons) and security (of assets).

This factor is key to some utilities such as UNELCO Engie, but very resource intensive (safety equipment’s, audits, redundancies, resilience investments etc.). - The level of reliance of territory on electricity taxes and contributions. How reliant are the Government and other para-Governmental agencies on electricity taxes and contributions to finance their operating budgets?

These are the elements of the customer bill that the utility does not control but that must be collected on behalf of third parties. Often, territories with low or no income taxes on companies and individuals, such as Vanuatu, must rely on other taxes (VAT, excise, customs and duty, for example), in order to finance the country’s budget.

Addition of all these taxes and contributions can have a significant impact on the customer’s final bill

… in the case of Vanuatu, rating these factors of adversity provides a clear picture as to the challenges and the factors that explain the cost of power:

“Adversity score”

| Adversity factorsData | Data | “Data Adversity score” |

| Distance from continent: | 1500 Km | HIGH |

| Fragmentation of territories | 83 | HIGH |

| Dispersion of territories | 663,251 km2 (EEZ) | HIGH |

| Size of each territory | 146 km2 (per island average) | HIGH |

| Density and economic makeup | 25 / km2 | HIGH |

| Wealth and risk of the territory | 2850 USD | HIGH |

| Exposure to geo-climactic hazards | (based on UNDP ranking) | HIGHEST |

| Quality, Continuity, Safety expectations | based on historical French heritage | very high |

| Reliance electricity taxes and contributions | 28% | HIGH |

The overall degree of adversity for electric systems is VERY HIGH in Vanuatu

Finally, it is important to be aware that customers that are privileged enough to be connected to the public grid represent a very small minority in Vanuatu (20 to 25%). As such, and in the spirit of unity, territorial continuity and solidarity, the Government of Vanuatu and UNELCO have collaborated over the years to define mechanisms by which current customers also help:

- Finance the network extensions to reach more remote villages and provide access (current customers contribute to providing access to new customers, who will in turn do the same, and so on)

- Subsidize the cost of new network connections in order to ensure that persons that are close to a grid, but who would not have the capital funds to pay for their service connection upfront, can still be collected for only a modest contribution.

- Subsidize the tariff accessible to the most modest “lifeline” (PCD) consumers (a third of customers pay less than half of the actual cost of their electric service; fighting “energy poverty” is a driver of social and economic progress)

- Subsidize the tariff for Tanna and Malekula customers so it is remains affordable and aligned with the Efaté tariff despite significantly higher operational costs.

- Contribute to financing the public lighting as it is a common good for the safety of the community …

while these mechanisms are without question of high economic and social value, they also contribute to increasing the short term cost borne by electric customers.